Private Student Loans

Banks and other financial institutions make private student loans without any direct financial backing from the federal government. This form of financing is entirely separate from the federal student loan program, and much smaller in size. As of 2024, the outstanding balance on private student loans is an estimated $130 billion, compared to nearly $1.7 trillion in outstanding federal student loans. Today, private student loans continue to be offered to students and their families as a way to supplement federal student loans when the cost of attendance at school exceeds federal borrowing limits and a family’s capacity to contribute. Most (nearly 90 percent) private student loans require a cosigner.

Private student loans generally do not offer the same protections as federal student loans. Interest rates may be higher than on federal loans, and lenders generally do not offer forbearances, or income-driven repayment plans. Discharging private student loans through bankruptcy has been notoriously difficult, although not impossible. Student borrowers are locked into contracts with private loan lenders, often including mandatory arbitration clauses.

In the 2000s, many private student lenders made huge profits by collaborating with predatory for-profit schools. One lender, Sallie Mae (now Navient) offered private loans to students at schools like ITT, Art Institutes, and Brooks knowing that students would likely not repay them. The loans were a loss-leader, a “baited hook” that allowed Navient to capture the lucrative and safe federally-guaranteed lending to students at those schools. Decades later, even after these schools are long gone, students and their family members who cosigned loans are still being held hostage. Many have repaid what they borrowed, but compounding interest means they owe that same amount twice over.

The principle that student loans, including private student loans, can be cancelled because of a school’s fraud and misconduct is recognized the by Federal Trade Commission’s “Holder Rule” In the last several years, PPSL has helped many borrowers get their federal student loans cancelled because of their school’s deceptive behavior and misconduct, yet their private loans have remained. However, 2024 has brought some positive movement toward getting 2000s-era predatory private student loans cancelled for a school’s misconduct. For more information on getting private loans cancelled, please visit here.

Despite these developments, more must be done to ensure that private lenders comply with federal and state consumer protection laws and that borrowers can access relief. Policymakers must also strengthen these protections and hold lenders accountable for their unlawful practices.

History of For-Profit Schools and Predatory Private Lending

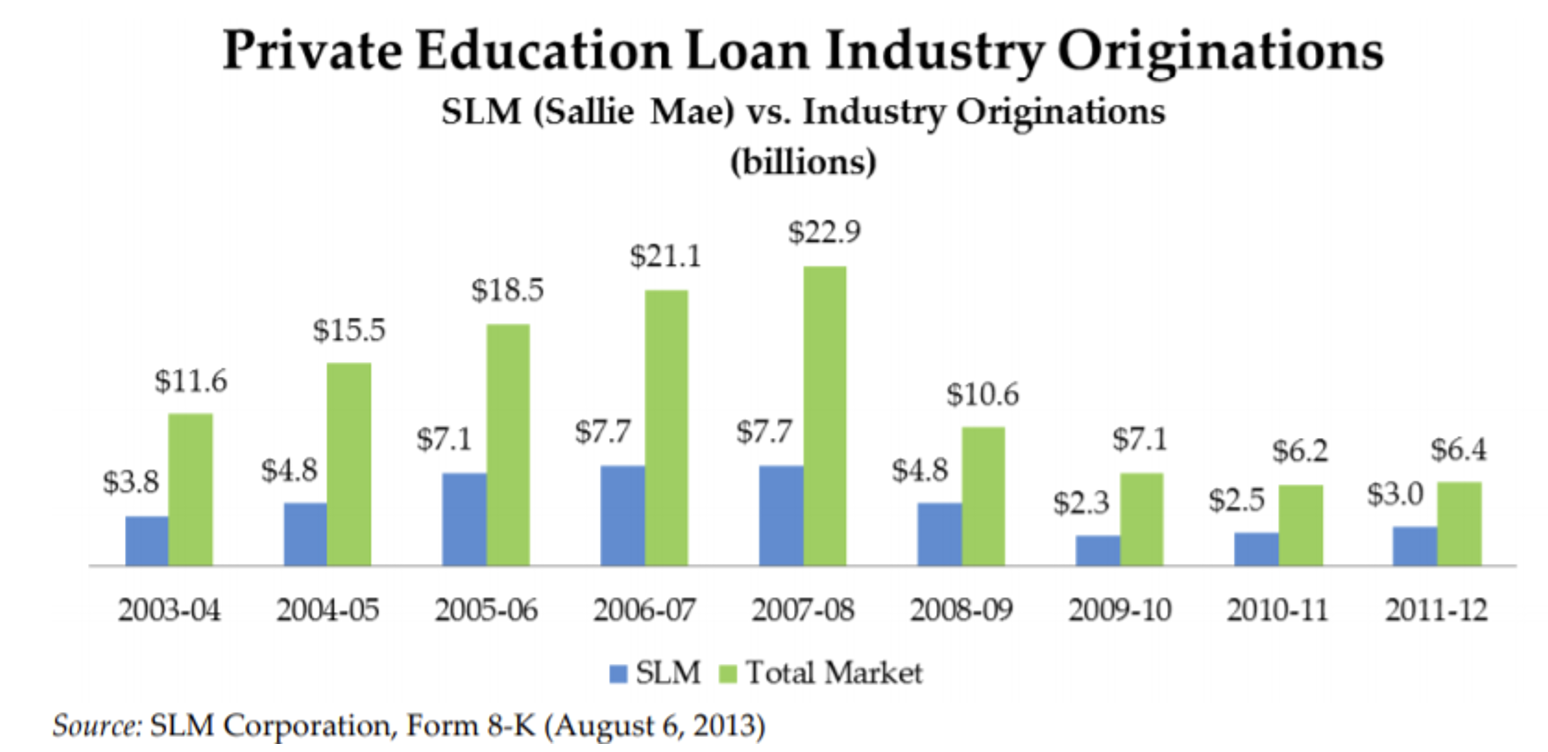

Private student lending skyrocketed during the 2000s. During this time, many lenders created predatory products designed to satisfy investors and schools, not borrowers. The lenders got away with these practices because they weren’t on the hook if student borrowers couldn’t pay. Instead, the lenders made the loans and then sold them to investors in the asset-based securitization market. The market for securitized student loans jumped 76% in 2006, to $16.6 billion, from $9.4 billion in 2005.

Predatory student lenders and for-profit schools benefited from working together while students suffered and continue to suffer.

Most for-profit schools needed these loans. In order to comply with federal law, 10% of a for-profit school’s revenue must come from sources other than Department of Education federal financial student aid, which includes federal student loans. This is known as the “90-10” rule. For-profit schools worked with private loan lenders to make loans to students in order to make sure they could reach their non-federal 10% revenue requirement, knowing the bad outcomes that awaited students.

In order to entice private loan lenders to lend to students that they knew would eventually default on the loans, many schools and lenders entered into recourse agreements (also known as Risk Share Agreements or RSAs) on certain loans, where the school agreed to cover all or a portion of losses that result from defaulted subprime private loans provided by the private loan lender. This relationship was a win-win for the lender and for the school: the school got access to federal funding and the lenders took on very little to no risk and were eventually paid back on the loans. Meanwhile, students were left with fraudulent unaffordable debt, even when the lender was made whole.

Sallie Mae and Navient

One of the biggest players in the private student loan space was Sallie Mae. Congress created Sallie Mae in 1972 to increase the supply of funds under the federal guaranteed student loan program. The company grew over time, ultimately abandoning its government sponsored status and becoming a fully private company in 2004. By 2007, Sallie Mae had a presence in nearly every aspect of government and private student lending and related businesses.

At the peak of private student lending in the late 2000s, Sallie Mae loans accounted for about 1/3 of all private student loan originations.

In 2014, Sallie Mae (SLM Corp.) split into two companies: Navient and Sallie Mae. After the split, and to date, Navient and its subsidiaries are the owners and servicers of existing private loans, while also continuing to own and service federal student loans. To this day, Navient owns billions of dollars of debt from these predatory for-profit schools.

Resources

For more information about private student loans, your rights, and local lawyers to help, visit the National Consumer Law Center’s Student Borrower Assistance website.

For more information about how to stop collectors from contacting you about private student loans, visit the Consumer Finance Protection Bureau’s website.

Read more in our memo sent on October 21, 2024 in response to Navient’s arguments about the scope of the Holder Rule here.