COVID College Cons – Bad Education Deals Sold in the Pandemic | Blog

A new series of articles called “COVID College Cons” launched by Republic Report and the Project on Predatory Student Lending to expose the predatory tactics that for-profit colleges are using right now to scam students in the midst of an economic and public health crisis. The purpose of this series is to warn the public about the schemes and help protect them from fraud.

COVID College Cons – Bad Education Deals Sold in the Pandemic

This article was written by Kate Manning Kennedy, senior advisor at the Project on Predatory Student Lending, and Michelle Wang, an intern at the project. It is part of a series, produced by Republic Report and the Project on Predatory Student Lending (part of Harvard Law School’s Legal Services Center) — COVID College Cons. This piece looks at some of the COVID-themed pitches, and poor educational records, of the some of the for-profit colleges seeking to enroll students and cash their federal aid checks during the pandemic.

DeVry University

In March 2020, for-profit DeVry University kick-started a new advertising campaign on Facebook, openly capitalizing on the uncertainty created by the mounting COVID-19 crisis. DeVry doesn’t tell prospective students that their school may not be the answer to their fears: DeVry was sued by the Federal Trade Commission for misleading ads touting high employment rates and has faced other law enforcement probes for deceptive recruiting. It also has a history of poor educational outcomes.  CARES Stimulus MoneyAs a for-profit company with an online platform, DeVry may be well positioned to benefit from this economic downturn. As an advance on these efforts, DeVry received nearly $5 million in taxpayer-funded stimulus money.Graduation RateAccording to College Scorecard, DeVry University locations average a 23 percent graduation rate. This means many who are lured in never complete their programs but are still weighed down by their federal student loan debts.Instructional Spending RatioBetween August 2016 and January 2017, DeVry spent only 24 percent of its revenue on instruction, according to an estimate by the Century Foundation. This means it is under-investing in learning and is spending more on advertising, recruiting, and profit.The DeVry ConThe DeVry con is illustrated by former students who have experienced it firsthand. Daniel Deegan is a plaintiff in Sweet v. DeVos, a class action lawsuit to force the U.S. Department of Education to process the backlog of borrower defense applications. Deegan enrolled in an online MBA program at DeVry’s Keller School of Graduate Management.Deegan was searching for career advancement. Instead he was misled and left with over $45,000 in federal student loan debt. To entice Deegan to enroll, DeVry sold him on inflated employment statistics, which ultimately influenced his choice to enroll. He was promised a new job with a higher salary after his program, but he has remained in the same job, with the same salary, until he was laid off not long after he received his MBA. He then spent several years without employment. DeVry told Deegan that its career services department would support him upon graduation. This never happened. On numerous occasions, Deegan called the career services department for help, left voicemail messages, and never heard back. In fact, Deegan never once received a return phone call or any assistance in finding a job.Deegan eventually found a job unrelated to his MBA. He struggles under the weight of his debt every day.“This debt affects everything – my willingness and ability to buy a house, get married, start a family – it puts your whole life on hold,” Deegan said. “The government found that these companies were crooks and sued them. It should be a no brainer that these loans are forgiven, but because of shameless greed, they denied my borrower defense claim saying I hadn’t presented enough evidence. Ask the F.T.C. why it went after DeVry for false marketing of untrue employment statistics. There is no doubt we were scammed and to insist otherwise is unjust.”Covid-19 has created the perfect storm for DeVry to target and scam students like Deegan looking to improve their lives. With its uptick in online advertising, DeVry seems to be positioning itself to take advantage of the opportunity.

CARES Stimulus MoneyAs a for-profit company with an online platform, DeVry may be well positioned to benefit from this economic downturn. As an advance on these efforts, DeVry received nearly $5 million in taxpayer-funded stimulus money.Graduation RateAccording to College Scorecard, DeVry University locations average a 23 percent graduation rate. This means many who are lured in never complete their programs but are still weighed down by their federal student loan debts.Instructional Spending RatioBetween August 2016 and January 2017, DeVry spent only 24 percent of its revenue on instruction, according to an estimate by the Century Foundation. This means it is under-investing in learning and is spending more on advertising, recruiting, and profit.The DeVry ConThe DeVry con is illustrated by former students who have experienced it firsthand. Daniel Deegan is a plaintiff in Sweet v. DeVos, a class action lawsuit to force the U.S. Department of Education to process the backlog of borrower defense applications. Deegan enrolled in an online MBA program at DeVry’s Keller School of Graduate Management.Deegan was searching for career advancement. Instead he was misled and left with over $45,000 in federal student loan debt. To entice Deegan to enroll, DeVry sold him on inflated employment statistics, which ultimately influenced his choice to enroll. He was promised a new job with a higher salary after his program, but he has remained in the same job, with the same salary, until he was laid off not long after he received his MBA. He then spent several years without employment. DeVry told Deegan that its career services department would support him upon graduation. This never happened. On numerous occasions, Deegan called the career services department for help, left voicemail messages, and never heard back. In fact, Deegan never once received a return phone call or any assistance in finding a job.Deegan eventually found a job unrelated to his MBA. He struggles under the weight of his debt every day.“This debt affects everything – my willingness and ability to buy a house, get married, start a family – it puts your whole life on hold,” Deegan said. “The government found that these companies were crooks and sued them. It should be a no brainer that these loans are forgiven, but because of shameless greed, they denied my borrower defense claim saying I hadn’t presented enough evidence. Ask the F.T.C. why it went after DeVry for false marketing of untrue employment statistics. There is no doubt we were scammed and to insist otherwise is unjust.”Covid-19 has created the perfect storm for DeVry to target and scam students like Deegan looking to improve their lives. With its uptick in online advertising, DeVry seems to be positioning itself to take advantage of the opportunity.

Strayer University

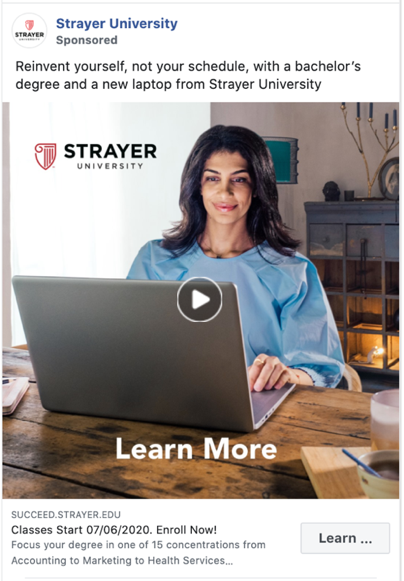

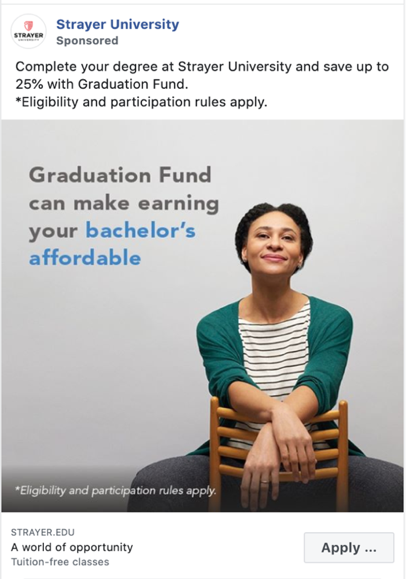

Strayer University has increased its online advertising presence since the COVID-19 pandemic began, promoting flexibility and offering incentives to enroll, such as free laptops and classes. Strayer’s “Graduation Fund,” for example, allows you to earn a free class for every three classes taken. But this promotion has many caveats. The free credits can only be redeemed at the end of your studies, and you lose all accumulated credits if you don’t enroll in classes for two or more consecutive quarters. Considering Strayer’s 46% retention rate for first-time, full-time students and low graduation rate, many students who are enticed by the promotion will probably never advance far enough to redeem it.

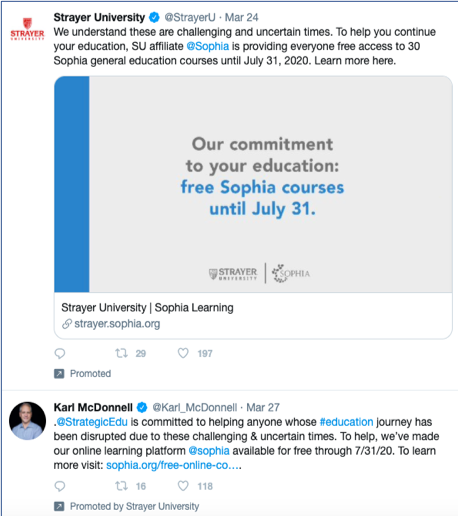

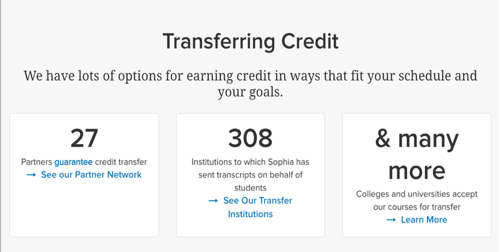

Strayer recently teamed up with Sophia Learning, an educational platform used by dozens of for-profit colleges, to provide free online courses until July 31st. It has marketed this offer as the answer to “challenging and uncertain times,” and stresses its commitment to “helping anyone whose education has been disrupted.” The advertisements notably fail to disclose that there are only 28 institutions that are guaranteed to accept Sophia Learning credits, many of which are other large for-profit institutions.

CARES Stimulus MoneyStrayer received $5,746,00 in stimulus funding.CORRECTION 07-22-20: Strayer declined to accept this CARES Act funded allocated to it. A Strayer spokesperson stated, “Given that Strayer University is predominantly online and only a small percentage of students take on-campus classes, Strayer declined to accept CARES Act funding and has established its own self-funded tuition grant to provide assistance to students who were originally enrolled in on-campus courses for the spring quarter 2020 and had to transition to online courses due to campus closures.” This piece originally stated, in error, that Strayer "received" the CARES funding. Graduation RateA 2015 Brookings study found that Strayer students had over $6.7 billion in accumulated debt, the sixth largest amount of debt out of the 3,000 schools in the report. Strayer’s low 15.2% average graduation rate and exceptionally high student loan debt mean most students never earn a degree but are highly burdened with student loan debt. Instructional Spending RatioA 2012 Senate Health, Education, Labor, and Pensions (HELP) committee report estimates that Strayer spent less than 10% of its tuition money on instruction. In 2009, Strayer spent $1,329 per student on instruction and $2,448 per student on marketing, bringing in $4,520 per student in profit. The Strayer ConStrayer has produced, overall, better results than same of the very worst for-profit schools. But many students have been left worse off than when they started. Like many Strayer students, Rebecca Weathers was convinced to enroll after seeing heavy advertising for the school. When she enrolled in the early 2000s, Strayer recruiters told Weathers that she would have no problem finding a job in Business Administration. During the eight years she was at Strayer, she never saw or heard from career services.To pay for the program, Weathers was encouraged to take out student loans and told that her Pell Grant would cover the payments. Weathers remembers taking out $25,000 in loans, but was continually pressured by Strayer to take out more. When she graduated with an associate degree in 2010, she was left with over $77,000 in student loans.“I was encouraged to withdraw and take Incompletes in classes,” Weathers said. “All the while, no one told me I would repeatedly take out more money to pay for these classes over and over. No one has listened to me and we are drowning under the student loans.”Weathers never got a single interview for a business administration-related position and received no assistance in finding employment in the field. Weathers had to get a second degree from a community college paralegal program to find a job.Still, the loans from her time at Strayer continue to burden, not only her, but also her family.“I cannot pay these loans,” she said. “The payments are ridiculous for a worthless piece of paper that has never brought a penny into my household. These loans are hurting three other family members besides myself. We cannot get our own home due to these loans.”Considering current high unemployment rates, students are especially likely to respond to Strayer’s tempting scholarships or free class coupons, despite its poor record of delivering on its promises.

CARES Stimulus MoneyStrayer received $5,746,00 in stimulus funding.CORRECTION 07-22-20: Strayer declined to accept this CARES Act funded allocated to it. A Strayer spokesperson stated, “Given that Strayer University is predominantly online and only a small percentage of students take on-campus classes, Strayer declined to accept CARES Act funding and has established its own self-funded tuition grant to provide assistance to students who were originally enrolled in on-campus courses for the spring quarter 2020 and had to transition to online courses due to campus closures.” This piece originally stated, in error, that Strayer "received" the CARES funding. Graduation RateA 2015 Brookings study found that Strayer students had over $6.7 billion in accumulated debt, the sixth largest amount of debt out of the 3,000 schools in the report. Strayer’s low 15.2% average graduation rate and exceptionally high student loan debt mean most students never earn a degree but are highly burdened with student loan debt. Instructional Spending RatioA 2012 Senate Health, Education, Labor, and Pensions (HELP) committee report estimates that Strayer spent less than 10% of its tuition money on instruction. In 2009, Strayer spent $1,329 per student on instruction and $2,448 per student on marketing, bringing in $4,520 per student in profit. The Strayer ConStrayer has produced, overall, better results than same of the very worst for-profit schools. But many students have been left worse off than when they started. Like many Strayer students, Rebecca Weathers was convinced to enroll after seeing heavy advertising for the school. When she enrolled in the early 2000s, Strayer recruiters told Weathers that she would have no problem finding a job in Business Administration. During the eight years she was at Strayer, she never saw or heard from career services.To pay for the program, Weathers was encouraged to take out student loans and told that her Pell Grant would cover the payments. Weathers remembers taking out $25,000 in loans, but was continually pressured by Strayer to take out more. When she graduated with an associate degree in 2010, she was left with over $77,000 in student loans.“I was encouraged to withdraw and take Incompletes in classes,” Weathers said. “All the while, no one told me I would repeatedly take out more money to pay for these classes over and over. No one has listened to me and we are drowning under the student loans.”Weathers never got a single interview for a business administration-related position and received no assistance in finding employment in the field. Weathers had to get a second degree from a community college paralegal program to find a job.Still, the loans from her time at Strayer continue to burden, not only her, but also her family.“I cannot pay these loans,” she said. “The payments are ridiculous for a worthless piece of paper that has never brought a penny into my household. These loans are hurting three other family members besides myself. We cannot get our own home due to these loans.”Considering current high unemployment rates, students are especially likely to respond to Strayer’s tempting scholarships or free class coupons, despite its poor record of delivering on its promises.

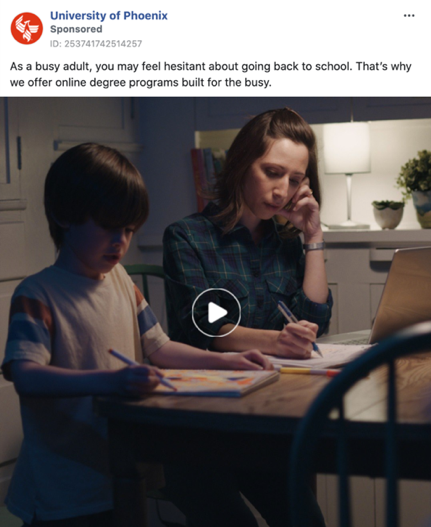

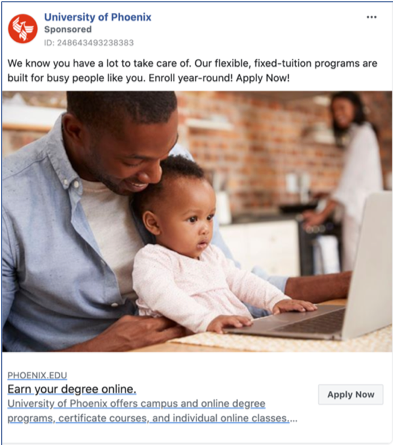

University of Phoenix

Since of the start of the pandemic, the University of Phoenix has ramped up its advertising for classes that promise flexibility and life-work balance. The University of Phoenix leveraged the country’s admiration for front-line workers by heavily promoting its nursing programs and the field’s projected job growth.Once they have left the school, however, many University of Phoenix students don’t gain the employment they were promised.Just last year, the University of Phoenix paid $191 million in fines and settlements after the FTC exposed the company for falsely claiming that it had special relationships with top companies and would provide exclusive job opportunities for University of Phoenix students. In March 2020, the Department of Veterans Affairs suspended enrollment of new G.I. Bill students after finding sufficient evidence of “erroneous, deceptive, or misleading” enrollment and advertising practices, although, in a controversial move, the VA ended that suspension a few months later.

CARES Stimulus MoneyAs one of the largest for-profit college companies, University of Phoenix received $6,589,433 in stimulus aid. Graduation RateBased on College Scorecard data, University of Phoenix locations average a 33% graduation rate. A 2015 Brookings study estimates that the University of Phoenix 5-year student loan default rate was 47%, almost double the average rate for bachelor’s degree holders. The University of Phoenix students owe more than $35 billion in student loan debt, the most of any US college. Instructional Spending RatioWith an enrollment of over 150,000 students, the University of Phoenix spends only 21% of its tuition money on instruction.The University of Phoenix ConShimell Hinesman, a former University of Phoenix student, lost her job during the 2007 recession and decided to enroll in the school’s IT program after seeing heavy online marketing and television commercials. Her cost of attending University of Phoenix was unreasonably high compared to state universities. While attending, the price of tuition doubled. Hinesman, hoping to avoid accumulating too much debt, took most of 2009 off from school. However, after being harassed with constant calls and emails from the school about losing her degree progress, she went back.Hinesman owes over $50,000 in both federal and private student loans. University of Phoenix financial advisors failed to inform Hinesman that she qualified for a federal Pell Grant, the National SMART Grant, and other financial aid benefits.“I let the advisor know how I felt misled and how he was negligent in his responsibility to assist me,” she said.Hinesman never got a job working in IT.Hinesman’s program inadequately prepared her on fundamental skills, and she has been working as an administrative assistant since graduating. She was recently promoted to a non-IT project management position due to a certification she received through the State of Georgia, not her University of Phoenix education or training.Hinesman’s story provides a cautionary tale for those impacted by the current economic crisis. Having lost her job during the 2007 financial crisis, Hinesman went back to school in search of greater job opportunities. In the face of broadly-felt employment instability, for-profit schools seize the opportunity to lure in impacted people. Now, the University of Phoenix is back to take advantage of another recession.

CARES Stimulus MoneyAs one of the largest for-profit college companies, University of Phoenix received $6,589,433 in stimulus aid. Graduation RateBased on College Scorecard data, University of Phoenix locations average a 33% graduation rate. A 2015 Brookings study estimates that the University of Phoenix 5-year student loan default rate was 47%, almost double the average rate for bachelor’s degree holders. The University of Phoenix students owe more than $35 billion in student loan debt, the most of any US college. Instructional Spending RatioWith an enrollment of over 150,000 students, the University of Phoenix spends only 21% of its tuition money on instruction.The University of Phoenix ConShimell Hinesman, a former University of Phoenix student, lost her job during the 2007 recession and decided to enroll in the school’s IT program after seeing heavy online marketing and television commercials. Her cost of attending University of Phoenix was unreasonably high compared to state universities. While attending, the price of tuition doubled. Hinesman, hoping to avoid accumulating too much debt, took most of 2009 off from school. However, after being harassed with constant calls and emails from the school about losing her degree progress, she went back.Hinesman owes over $50,000 in both federal and private student loans. University of Phoenix financial advisors failed to inform Hinesman that she qualified for a federal Pell Grant, the National SMART Grant, and other financial aid benefits.“I let the advisor know how I felt misled and how he was negligent in his responsibility to assist me,” she said.Hinesman never got a job working in IT.Hinesman’s program inadequately prepared her on fundamental skills, and she has been working as an administrative assistant since graduating. She was recently promoted to a non-IT project management position due to a certification she received through the State of Georgia, not her University of Phoenix education or training.Hinesman’s story provides a cautionary tale for those impacted by the current economic crisis. Having lost her job during the 2007 financial crisis, Hinesman went back to school in search of greater job opportunities. In the face of broadly-felt employment instability, for-profit schools seize the opportunity to lure in impacted people. Now, the University of Phoenix is back to take advantage of another recession.

Colorado Technical University

Colorado Tech seized the moment of the COVID pandemic to launch a Facebook advertising campaign that appears to have been dormant since 2018. Now the university has over 50 active Facebook and Instagram advertisements centered around short, flexible programs that claim to prepare people for a career in the healthcare industry. The campaign exploits the admiration of front-line workers during the pandemic.Behind the extensive marketing, Colorado Tech is notorious for defrauding students. In January of last year, Colorado Tech’s parent company, Perdoceo Education, previously known as Career Education Corporation, agreed to cancel over $500 million of their former students’ loans after facing allegations of misleading job placement rates and cost of attendance. In March 2020, the Department of Veterans Affairs suspended GI Bill enrollments for Colorado Tech, which generated over $45 million in revenue in 2018 from its GI Bill students. The VA found sufficient evidence to show Colorado Tech used deceptive marketing and recruitment tactics. (Unfortunately, as with the University of Phoenix, the VA dropped that punishment within a few months.)

CARES Stimulus MoneyDespite pushback in Washington over for-profit colleges collecting CARES stimulus money, Colorado Tech received over $1.5 million in stimulus funding.Graduation Rate

CARES Stimulus MoneyDespite pushback in Washington over for-profit colleges collecting CARES stimulus money, Colorado Tech received over $1.5 million in stimulus funding.Graduation Rate

Colorado Tech’s graduation rate is just 25%, while its students still owe over $3.3 billion in student loans for degrees most do not finish.

Instructional Spending RatioAmong similar online colleges, Colorado Tech spent the smallest proportion of tuition on instruction at just 9%. Instead of investing in the quality of its education, Colorado Tech spends millions a year on growth marketing, executive salaries, and recruitment. The Colorado Tech ConA former Colorado Tech student, Leanne Crippen, enrolled in the school’s Project Management program after seeing a television advertisement.“Too easy,” she said. “I was unemployed and thought it was strange how they approved me for everything.”While in the Project Management program, Crippen received no assistance in finding externships or hands-on work. It was only after leaving the program that she found out that a Project Management externship was part of the program, but had to be done on campus. Without any professional experience, Crippen never had proper qualifications for project management roles. She looked for a degree-related job for four years and never found one. She’s now employed in a different field altogether.Crippen still owes over $85,000 in student loans for a degree that was completely misrepresented and ultimately useless. For-profit colleges take advantage of vulnerable groups like the unemployed. With its most aggressive advertising campaign yet, Colorado Tech is attempting to lure in more students than ever.A recent Republic Report expose, based on the accounts of current and recent employees of Colorado Tech and another Perdoceo school, American Intercontinental University, confirmed that the Perdoceo schools continue to engage in deceptive and coercive recruiting, enrolling numerous students in programs that will wreck their financial futures. —–For-profit colleges are not the only actors in high education taking advantage of pandemic funding. A number of the for-profit college accreditors – the gatekeepers whose approval makes schools eligible for student grants and loans – have received federal loans, convertible into grants, from the Small Business Administration’s Paycheck Protection Program (PPP). Notably, one of those PPP recipients, as the group Accountable.US recently pointed out to us, is the controversial accreditor the Accrediting Council for Independent Colleges and Schools (ACICS).In 2016, after reviewing voluminous evidence that ACICS was asleep at the switch, failing to catch or penalize bad behavior at notorious for-profit college chains including Corinthian, ITT, EDMC, and ATI, the Department of Education dropped ACICS as a recognized accreditor, meaning ACICS approval no longer provided schools with access to federal aid. As part of a sweeping effort to weaken accountability for college abuses, Trump education secretary Betsy DeVos restored ACICS, but the accreditor had already lost much of its business, as many schools sought to move to other accreditors, and has been in a perilous state, especially after a February USA Today report that Reagan National University, a school approved by ACICS, was a fraud, seemingly without any students or faculty. DeVos has deferred further review of ACICS into 2021. Does it make sense for taxpayers to be propping up ACICS now?Republic Report is dedicated to rooting out the corruption that is so corrosive to American values. We investigate and uncover the buying and selling of politicians and of institutions entrusted with upholding the public interest. We expose how big money distorts major policy decisions – harming our economy and our people.